Where Business Succeeds

Carroll County has the tools you need to succeed.

Whether you’re an entrepreneur or an established business, let the CCED help you today with your company’s needs.

Many new and growing businesses call Carroll County home. It’s a thriving suburban county with innovators in such industries as agriculture and manufacturing, education and technology, banking and finance, food service and catering, automotive, HVAC and trade services.

The Carroll County Department of Economic Development (CCED) is committed to business, partnering with business owners to lend the support needed to start a new venture or expand an existing enterprise. Our experienced professionals assist you in selecting the best location for your business, whether coordinating permits and construction requirements or matching you with seasoned commercial real estate experts. When it’s time to secure funding for your venture, we connect you with programs to secure tax credits and grants in addition to local financial institutions who determine the right loan products to meet your long-term needs. Workforce development is a priority in Carroll County, where more than 96,000 highly-skilled and educated members of the labor force reside. We link you to the many resources available to help prepare and keep your employees trained to ensure your company’s success.

For all of your needs, Carroll County is your partner in business.

“We help businesses start, grow and maintain success. Our consultants are armed with the knowledge and expertise to help small business owners develop strategies for success and turn their dreams into reality.”

Darren Peyton – Asst. Director/Business Consultant, SBDC

We know BUSINESS

Carroll County has the tools you need to succeed.

Whether you’re an entrepreneur or an established business, let the CCED help you today with your company’s needs.

Many new and growing businesses call Carroll County home. It’s a thriving suburban county with innovators in such industries as agriculture and manufacturing, education and technology, banking and finance, food service and catering, automotive, HVAC and trade services.

The Carroll County Department of Economic Development (CCED) is committed to business, partnering with business owners to lend the support needed to start a new venture or expand an existing enterprise. Our experienced professionals assist you in selecting the best location for your business, whether coordinating permits and construction requirements or matching you with seasoned commercial real estate experts. When it’s time to secure funding for your venture, we connect you with programs to secure tax credits and grants in addition to local financial institutions who determine the right loan products to meet your long-term needs. Workforce development is a priority in Carroll County, where more than 96,000 highly-skilled and educated members of the labor force reside. We link you to the many resources available to help prepare and keep your employees trained to ensure your company’s success.

For all of your needs, Carroll County is your partner in business.

“We help businesses start, grow and maintain success. Our consultants are armed and ready with the knowledge and expertise to help small business owners develop strategies for success and turn their dreams into reality.”

Steven Colella – Business Consultant, SBDC

sbdc and you

The Small Business Development Center (SBDC) was tasked by the United States Small Business Administration, through the Carroll County Department of Economic Development, to provide the tools that small businesses need to be successful.

SBDC advisors have first-hand business knowledge and expertise to guide budding entrepreneurs and existing business owners. Our services are provided free of charge to small businesses, who take advantage of any or all of the assistance we offer.

sbdc and you

The Small Business Development Center (SBDC) was tasked by the United States Small Business Administration, through the Carroll County Department of Economic Development, to provide the tools that small businesses need to be successful.

SBDC advisors have first-hand business knowledge and expertise to guide budding entrepreneurs and existing business owners. Our services are provided free of charge to small businesses, who take advantage of any or all of the assistance we offer.

Entrepreneurs

Our SBDC counselors work with individuals who have an idea but need support and guidance to see it come to fruition. SBDC professionals assist entrepreneurs to further develop ideas and test their business concepts. Counselors provide assistance in formulating business and marketing plans and developing strategies to overcome challenges and complete operational plans.

Established Businesses

Owners of established businesses turn to the SBDC at various stages of growth. Some need guidance to turn a young enterprise into a profitable venture. Others need assistance to take the next step — expanding services, renovating a current location or moving to a larger space. These projects come with a set of challenges that can be solved with the help of seasoned experts, who work with business owners to get what they need to take this next step to success.

starting your business

entrepreneurs

All businesses start out as an idea, but the idea alone is not enough to successfully launch an enterprise. Small Business Development Center advisors work with entrepreneurs to evaluate ideas, analyzing market research and industry trends, helping to determine whether your passion can translate into a successful and profitable venture.

We work to help you focus on the “business of the business.” This means taking your expertise and developing a business plan, a roadmap that will guide the operation. We assist with financial planning, helping to calculate startup or franchise costs, secure funding for the operation and develop pricing guidelines to help your business grow. Our connections help you access all of the resources you need to get started on the path to success.

EASY AS 1-2-3

Meet with Counselor

Our counselors assist in the discovery phase of your business, determining product or service viability, and working to understand your short and longterm goals.

Plan

Together, we develop a detailed business plan to guide the operation and a marketing plan to spread the word about your business. We make connections to funding sources to enable startup.

Deploy

Putting your plans into action, we help you navigate the road to success and provide support to meet challenges along the way.

“A lot of people don’t know how to turn their passion into profit. The SBDC helps the business owner understand the business side of the business.”

Tiombe Piage – Owner, Cultivated – Westminster

growing your enterprise

established businesses

Established businesses have different needs than those just starting out. It could mean assistance with human resources — hiring and training as the business grows. Growing businesses also need to update their business plan to reflect current operations. Future expansion plans may involve meeting with a venture capitalist or financial institution. Or a discussion could reveal a legal issue or a need for tools to help expand capabilities or better handle growth.

Whatever the challenge facing established businesses, SBDC has the connections to ensure continued growth and profitability. We share economic trends, market conditions and financial resources as we work with you to address current requirements and anticipate your future needs.

EASY AS 1-2-3

Uncover the Need

SBDC consultants collaborate with businesses to determine areas of need.

Gather Resources

Connections to experts in a variety of industries from legal, finance, human resources and training, and education that can lend experience and advice to ensure continued growth and success.

Engage

Our network of experts engage with owners to solve initial needs and plan for the future.

“A lot of people don’t know how to turn their passion into profit. The SBDC helps the business owner understand the business side of the business.”

Tiombe Paige – Owner, Cultivated – Westminster

resources

ALEX & HOLLY BUSH – OWNERS, MARATHON TECHNOLOGY SOLUTIONS – ELDERSBURG

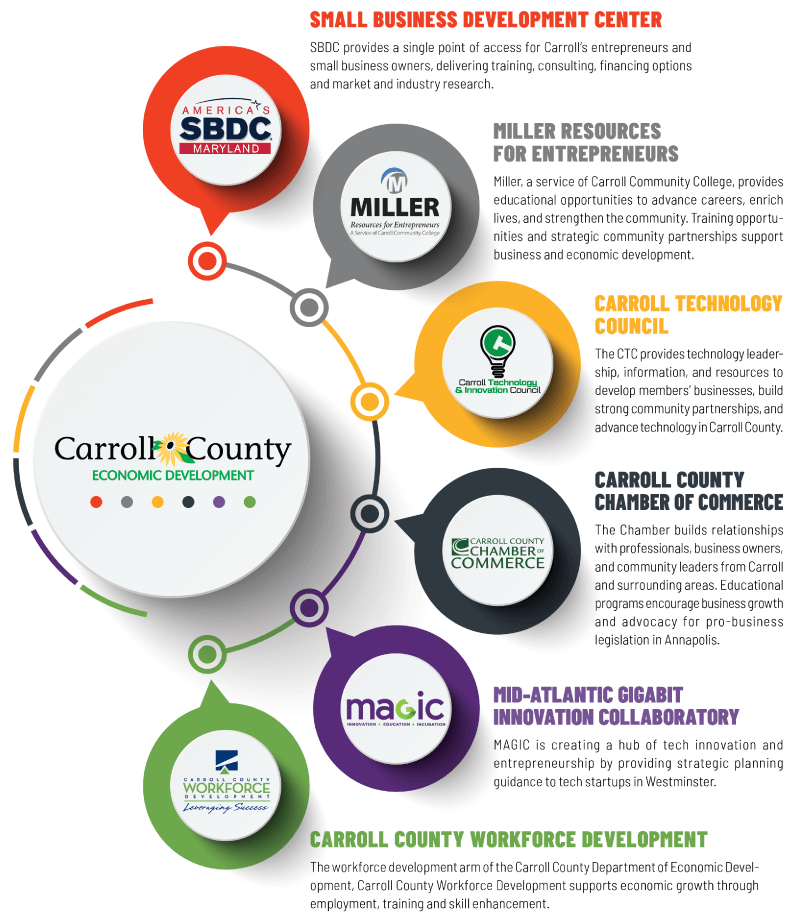

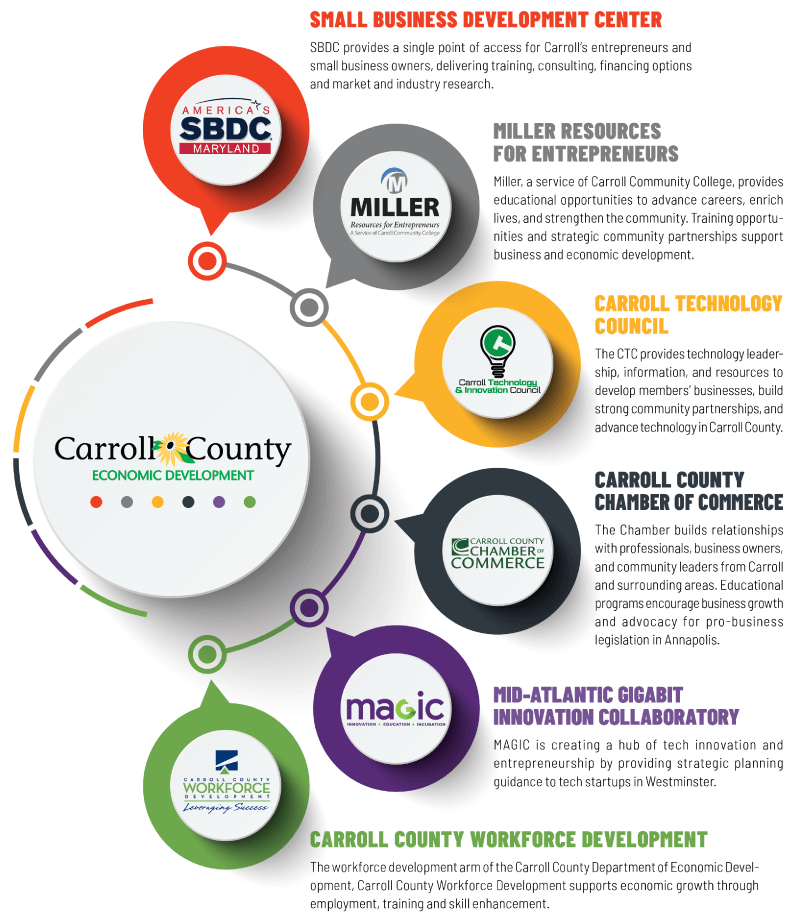

The Carroll County Department of Economic Development supports thriving businesses in a variety of industries at different stages of existence. CCED serves as the guide that directs business owners to the wealth of available tools they can utilize in their pursuit of success.

At startup or during growth, business owners need guidance with the process needed to take an idea and develop it into reality. They turn to the Small Business Development Center for advice and support as they work to ensure their idea not only comes to fruition but also becomes a self-sustaining entity. The Carroll County Chamber of Commerce and the Carroll Technology & Innovation Council connect business owners for networking, generating leads, and sharing ideas and strategies for tackling similar hurdles. Carroll Community College and Carroll County Workforce Development provide opportunities for business owners and their staff to grow their skills, whether through training or continuing education programs or in pursuit of a degree. Tech incubator MAGIC, the Mid-Atlantic Gigabit Innovation Collaboratory, provides assistance to tech startups.

The Carroll County Department of Economic Development is uniquely positioned to help existing & prospective businesses take full advantage of all that Carroll County has to offer.

resources

The Carroll County Department of Economic Development is uniquely positioned to help existing & prospective businesses take full advantage of all that Carroll County has to offer.

The Carroll County Department of Economic Development supports thriving businesses in a variety of industries at different stages of existence. CCED serves as the guide that directs business owners to the wealth of available tools they can utilize in their pursuit of success.

At startup or during growth, business owners need guidance with the process needed to take an idea and develop it into reality. They turn to the Small Business Development Center for advice and support as they work to ensure their idea not only comes to fruition but also becomes a self-sustaining entity. The Carroll County Chamber of Commerce and the Carroll Technology Council connect business owners for networking, generating leads, and sharing ideas and strategies for tackling similar hurdles. Carroll Community College and the Business/Employment Resource Center (BERC) provide opportunities for business owners and their staff to grow their skills, whether through training or continuing education programs or in pursuit of a degree. Tech incubator MAGIC, the Mid-Atlantic Gigabit Innovation Collaboratory, provides assistance to tech startups.

“Carroll County offers a strong economic climate that enables small business success. We have built important connections with other businesses and we support each other in working toward our individual and collaborative goals.”

Alex & Holly Bush – Owners, Marathon Technology Solutions – Eldersburg

“I work to establish relationships and provide the tools needed for businesses to prosper. The fun part of my job is meeting with small business owners and watching their businesses grow and thrive.”

Michelle Williams – Vice President, M&T Bank, Mount Airy

The biggest challenge is funding your ideas

Small businesses need capital for office construction, supplies, product inventory and much more. Business owners turn to financial institutions for funding. Sharing a business plan, vision, client base, and financial projections enables institutions to determine the appropriate financial products that can fund the road to success.

Term Loan.

A term loan is designed to fund a specific purpose with an associated time frame. It could mean money for a fleet of vehicles over five years or a 20-year mortgage for a building purchase. The term includes paying back the loan plus interest over a specific period of time.

Line of Credit.

Lenders extend lines of credit to businesses needing short-term capital on a revolving basis. The funds are borrowed and paid back, usually within a 90-day window, for such needs as supplies, inventory, surplus labor, and other expenses that necessitate a larger cash flow in a short window of time.

SBA Guaranteed Loan Program.

Five Carroll County institutions are designated as preferred lenders with the Small Business Administration and are able to provide commercial loans to startups and small businesses through the SBA Guaranteed Loan Program. The program, designed to make securing a loan easier and faster for small businesses with reduced risk to the lending partner, offers lower down payments, flexible overhead requirements and limited collateral conditions.

The biggest challenge is funding your ideas

Small businesses need capital for office construction, supplies, product inventory and much more. Business owners turn to financial institutions for funding. Sharing a business plan, vision, client base, and financial projections enables institutions to determine the appropriate financial products that can fund the road to success.

Term Loan.

A term loan is designed to fund a specific purpose with an associated time frame. It could mean money for a fleet of vehicles over five years or a 20-year mortgage for a building purchase. The term includes paying back the loan plus interest over a specific period of time.

Line of Credit.

Lenders extend lines of credit to businesses needing short-term capital on a revolving basis. The funds are borrowed and paid back, usually within a 90-day window, for such needs as supplies, inventory, surplus labor, and other expenses that necessitate a larger cash flow in a short window of time.

SBA Guaranteed Loan Program.

Five Carroll County institutions are designated as preferred lenders with the Small Business Administration and are able to provide commercial loans to startups and small businesses through the SBA Guaranteed Loan Program. The program, designed to make securing a loan easier and faster for small businesses with reduced risk to the lending partner, offers lower down payments, flexible overhead requirements and limited collateral conditions.

“I work to establish relationships and provide the tools needed for businesses to prosper. The fun part of my job is meeting with small business owners and watching their businesses grow and thrive.”

Michelle Williams – Vice President, M&T Bank, Mount Airy

“From obtaining permits to health department inspections, everyone in Carroll County is accommodating and easy to work with. CCED helped us transform from an e-commerce equipment business to a restaurant ready to add a second kitchen and expand our seating.”

Steve & Leah Rogers – Owners, Outlaw Barbecue – Hampstead

Frequently Asked Questions

How much money do I need to start a business?

Money is the top concern for business owners. How much is needed depends on many variables. When we meet with clients, we pull industry data and evaluate trends. We also discuss what the owner intends to yield from the business. Is it a hobby performed after regular business hours or is this a full-time focus intended to support the business owner’s family?

Aspiring entrepreneurs need to consider startup and operating expenses when evaluating the business’ profitability potential. What is the budget needed to pay expenses and what is the expected cash flow? How will they turn a profit?

What other resources do I need as a business owner?

It’s important for business owners to align themselves with “subject matter experts,” service professionals who focus on the core function of the business. Businesses need expert accounting, legal, insurance and banking professionals who can provide assistance when it’s needed. It’s like laying the foundation before building the house. Business owners should place a high value on their own time and expertise, but also an even higher value on the work and resources that others can offer.

How do I find space to locate my business?

Contact a commercial real estate agent. They are experts who know the local market and can offer guidance on locations and specific properties. The Carroll County Department of Economic Development works closely with realtors, brokers and property owners to keep an accurate inventory of available properties in the county. We work with entrepreneurs and business owners to determine monthly and annual budgets including financial projections to determine what’s affordable. Using an agent does not cost the business owner a penny. Real estate agents earn money from the transaction.

Do I need a business plan?

The answer is yes and no. The business plan’s primary purpose is to provide a concise summary of its operation to a lender or investor who may supply capital for the business. A business plan is not a necessity; however, all businesses should have a business plan. It doesn’t have to be a formal, 30-page document, but it should outline routine operations at startup and as the business grows. Often referred to as a road map for the business, the plan should show other routes and options if there is a roadblock, if something gets in the way and you need to go in another direction.